TL;DR — Why This Matters

The insurance industry has quietly undergone a technological revolution — and drones are at its center. The top U.S. carriers, including Allstate, State Farm, Farmers, and Travelers, now rely on FAA-certified drone inspections to assess claims faster, safer, and more accurately than ever beforeInsurance Industry Adoption of …. What once took an adjuster a full day with a ladder now takes under an hour, cutting claim cycle times by 30–40% and saving insurers 20–35% in inspection costsInsurance Industry Adoption of ….

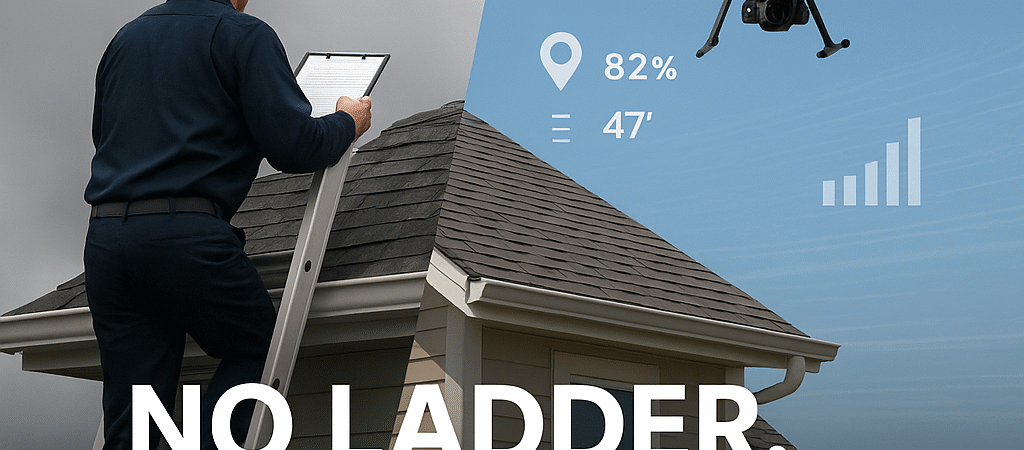

But this isn’t just about efficiency — it’s about safety and liability. Drones have virtually eliminated the need for adjusters to climb roofs, reducing fall-related injuries by up to 91%, and protecting both workers and insurers from the $27,000 average direct cost of each fallInsurance Industry Adoption of …. Policyholders benefit too: faster payouts, more accurate claims, and even premium discounts for those who use preventive drone inspections.

This report reveals how the industry’s “No Ladder. No Liability.” model is redefining claims management, proving that safety innovation is not only ethical — it’s profitable.

Major Insurers Embracing Drones for Roof Inspections

Leading property insurers have widely adopted drone technology to assess roof damage and other property claims. Major carriers like Allstate, State Farm, Farmers, USAA, and Liberty Mutual have established formal protocols to accept drone inspection reports as part of their standard claims processstructionsolutions.comstructionsolutions.com. For example, Allstate began testing drones in 2015 and deployed them nationally by 2017 for catastrophe response, after seeing how aerial imagery could put “eyes in the sky” post-disastertheatlantic.com. Travelers Insurance launched its drone program in 2016 and now has over 650 FAA-certified drone pilots on staff across 48 statesaloft.aialoft.ai. These early investments by top insurers reflect an industry trend – drones are increasingly viewed as essential tools in claims adjusting rather than novelties. Insurers already account for a significant share of commercial drone use (one Deloitte analysis found 17% of U.S. commercial drones are operated by insurance companies)intellias.com, underscoring how rapidly the technology has become mainstream in the insurance sector.

Faster Claim Settlements and Improved Efficiency

Drone inspections dramatically accelerate the claims cycle. Because a drone can survey a roof in minutes, adjusters can handle far more inspections per day than with traditional methods. Allstate found that an adjuster using drones could photograph seven homes’ roofs in just a few hours, whereas previously an adjuster might inspect only three roofs in a full daytheatlantic.com. Farmers Insurance shared a similar metric: with drones, an adjuster can process three houses in an hour, versus three houses in a day without themintellias.com. This speed translates into faster claim settlements – what used to take days of scheduling and ladder climbing can often be done in under an hour nowtheatlantic.com. Overall claim cycle times have been cut by about 30–40% at insurers that deploy aerial imagery, according to industry benchmarks. In one case study, an AWS-supported drone inspection platform (Bees360) helped carriers reduce underwriting inspection turnaround by 40%. Quicker assessments mean policyholders get paid sooner, and insurers improve customer satisfaction in the critical post-disaster period. As a Travelers executive observed, “Customers love that it’s done fast, and claim professionals appreciate the convenience and safety. It’s a win-win.”aloft.ai. Many insurance companies now advertise 24–48 hour response times for drone-based inspections – a pace traditional ladder inspections simply cannot matchstructionsolutions.com.

Lower Loss-Adjustment Costs and Fraud Reduction

Beyond speed, drones drive down the cost of handling claims. Replacing manual roof climbs with drone surveys reduces travel, equipment, and labor expenses for insurers. Early adopters report roughly 20–35% savings in inspection-related costs once drone programs are in placestructionsolutions.comstructionsolutions.com. A notable example is that carriers saw about a 30% reduction in loss adjustment expenses (LAE) after implementing drone-assisted inspections. These savings come from efficiency gains and also from avoiding unnecessary loss payouts. High-resolution aerial photos create an indisputable record of property condition, which helps prevent inflated or fraudulent claims. Adjusters armed with clear drone imagery can more easily deny claims for pre-existing damage and spot inconsistencies, reducing costly disputes. In fact, insurers say drones “eliminate false claims and disputes” by providing objective visual evidence of damage (or lack thereof)intellias.com. The consistency of automated drone data also means fewer re-inspections – one firm’s AI-driven quality checks cut reinspection costs by 50% by catching errors earlystructionsolutions.comstructionsolutions.com. Overall, better data leads to more accurate claim payouts. Insurers even noted slight improvements in loss ratios (on the order of a 3% reduction) after adopting drone and AI inspection programs, thanks to avoiding surprise roof failures and pricing risk more precisely.

Safety Benefits and Liability Reduction (“No Ladder, No Liability”)

Insurance adjusters and executives alike have embraced drones for making the job safer. Traditionally, inspecting roofs is one of the most dangerous tasks in insurance – adjusters had to climb ladders, walk on wet or damaged roofs, and risk serious fallstheatlantic.comtheatlantic.com. Ladder-related falls remain a major hazard, causing hundreds of worker injuries and fatalities each year in the U.S.. Drones essentially eliminate this risk by keeping adjusters on the ground. **“No ladder” means virtually no fall liability for the insurer’s employees or contractors. Farmers Insurance explicitly noted that using drones carries “less safety risks to field adjusters” than traditional roof climbsnewsroom.farmers.com. Data backs this up: workplace studies in construction and insurance find drone inspections can cut fall-related accidents by up to 91%. Every accident avoided not only protects people but also spares the company substantial costs (the average direct cost of a single ladder fall is ~$27,000 in medical and lost-time expenses). Insurers also avoid potential litigation and workers’ comp claims stemming from adjuster injuries. In short, drones reduce the liability exposure for insurers during claims inspections. As one Travelers administrator put it, once they saw how drones “dramatically improve the way we serve customers” safely, “there was no going back”aloft.aialoft.ai. Adjusters themselves have welcomed the change – freed from lugging ladders and entering unstable structures, they can focus on analyzing imagery. They report that the convenience and safety of drone workflows allow them to work more efficiently without the constant fear of fallsaloft.ai. This safety-first approach also has PR benefits: insurers can proudly emphasize that they keep their employees out of harm’s way while still delivering fast service to customers.

Premium Incentives for Policyholders and Regulatory Endorsements

Insurers not only use drones internally, they are starting to encourage policyholders to leverage drone inspections for prevention. Several carriers now offer premium discounts or incentives to homeowners and commercial clients who get regular drone roof surveys and fix small issues proactively. The logic is simple: a well-documented maintenance history reduces the likelihood of surprise large losses. For instance, if a homeowner provides a recent drone report showing the roof in good condition, an insurer may give a credit on premiums because the risk of undetected pre-existing damage is lower. Some commercial insurance guidelines even list periodic aerial inspections as a best practice in risk management, since catching a minor roof leak early can prevent a major claim later. This trend creates a win-win: clients pay less over time, and insurers face fewer big claims.

Regulators have taken note as well. The National Association of Insurance Commissioners (NAIC) and state insurance departments generally support any innovation that speeds up claims and improves accuracy (while cautioning about privacy). For example, the Ohio Department of Insurance (ODI) explicitly urges homeowners to thoroughly document storm damage with photos “immediately after a storm”, highlighting that aerial drone photos are especially valuable for capturing roof damage and fallen trees that ground-level shots might miss. Ohio regulators note that such thorough photo evidence can expedite the claims process with insurers. They even recommend policyholders keep “before” images on file – like a drone survey of the roof in good condition – so that after a storm it’s clear the damage was new, helping speed up claim approval by avoiding disputes over pre-existing issues. Other states provide similar guidance in disaster preparedness toolkits, essentially endorsing aerial documentation as a means to quicker, smoother claims. In summary, the industry consensus – from frontline adjusters to CEOs and even regulators – is that drone-assisted inspections improve efficiency, reduce costs and liabilities, and benefit everyone involved in the insurance claim processaloft.ai.